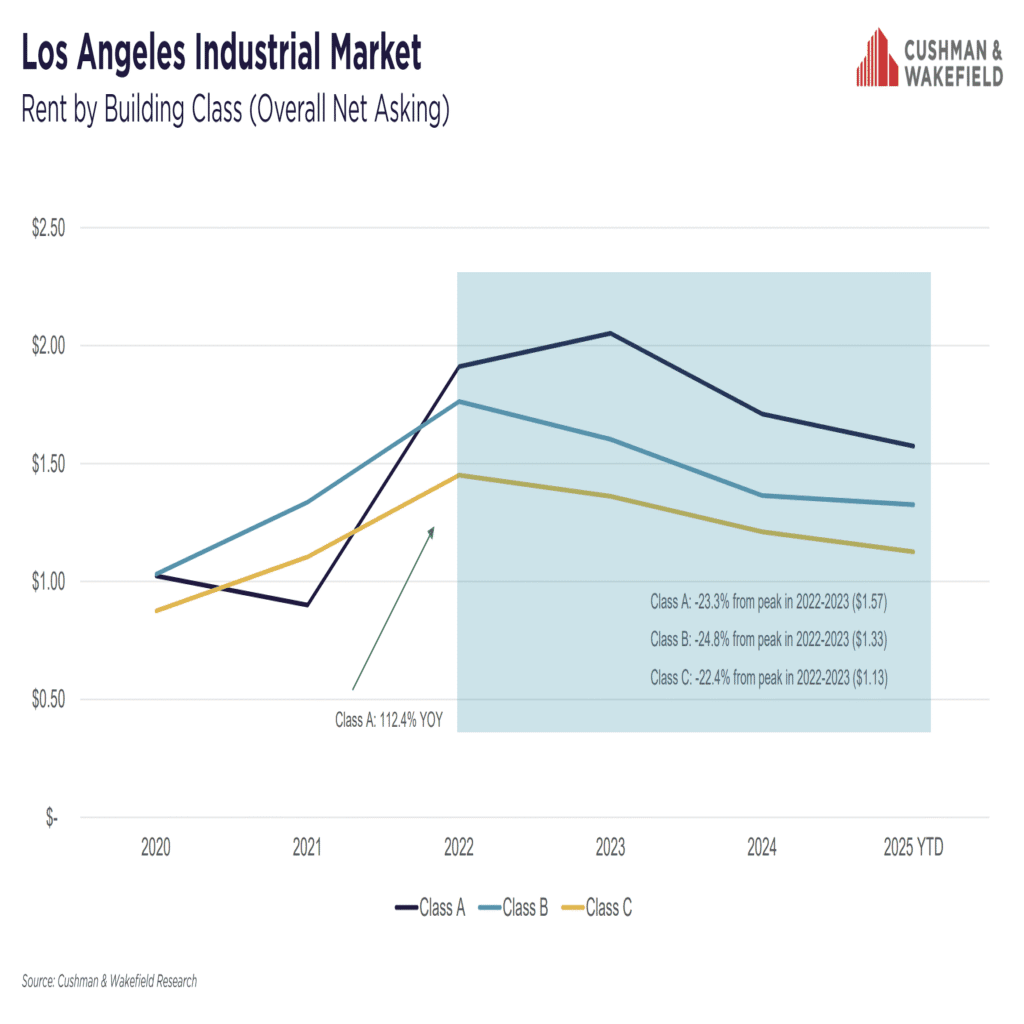

The frantic pace of LA’s warehouse world has slowed. A recent report shows things are stabilizing – demand holds firm while rental costs ease, yet investors remain optimistic about what comes next. Rents are shifting. Top-tier warehouses now average around $1.57 a square foot – a drop of roughly 23% since peaks in 2022 and 2023. Both Class B and Class C properties saw declines – about 25% and 22% each. This is quite different from earlier times; during the pandemic, demand soared, causing Class A rental costs to more than double annually.

Rental Rate Trends

• Class A rates down 23.3% from peak

• Class B rates down 24.8% from peak

• Class C rates down 22.4% from peak

Despite everything, things feel solid. Numbers from Cushman & Wakefield suggest the market isn’t getting smaller, instead it’s finding its footing. Top-tier offices keep filling up – tenants are signing leases at a better rate than spaces opening – even as older buildings gradually recover from recent difficulties.

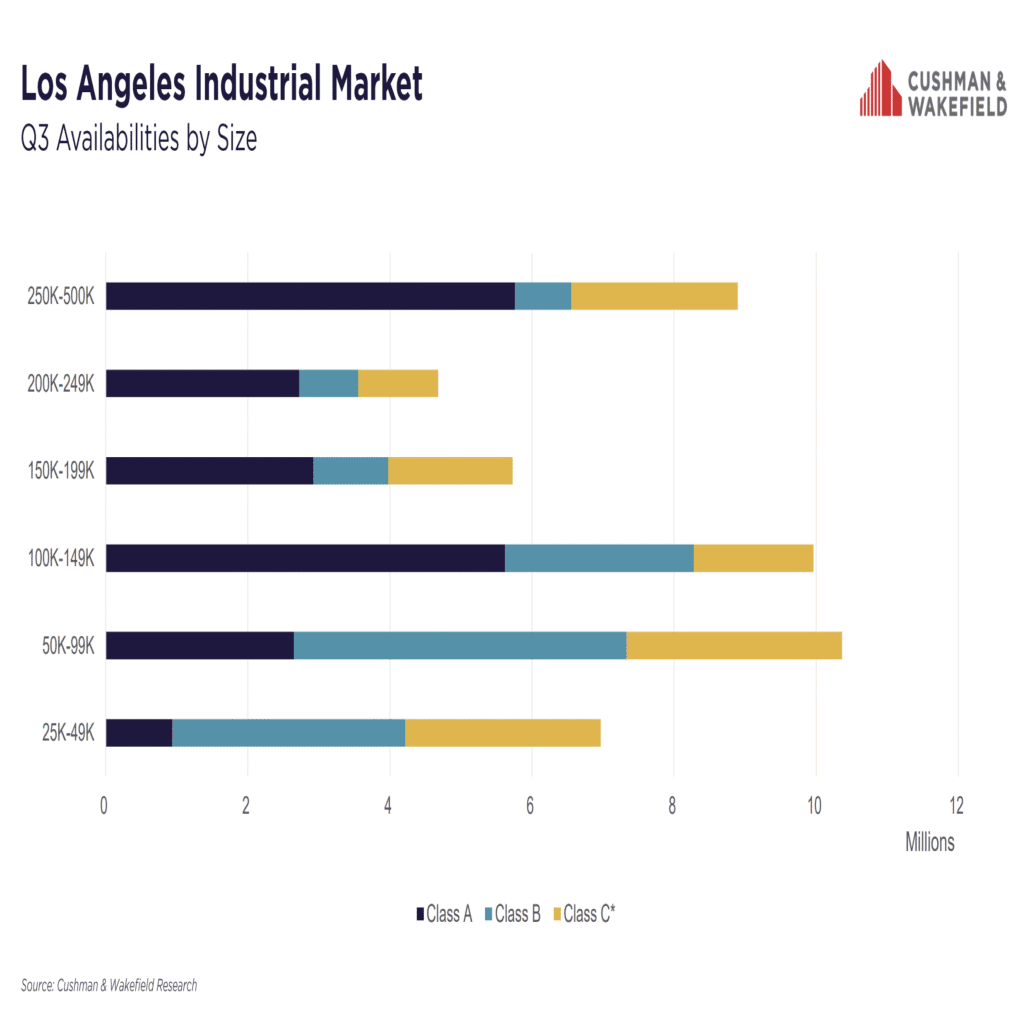

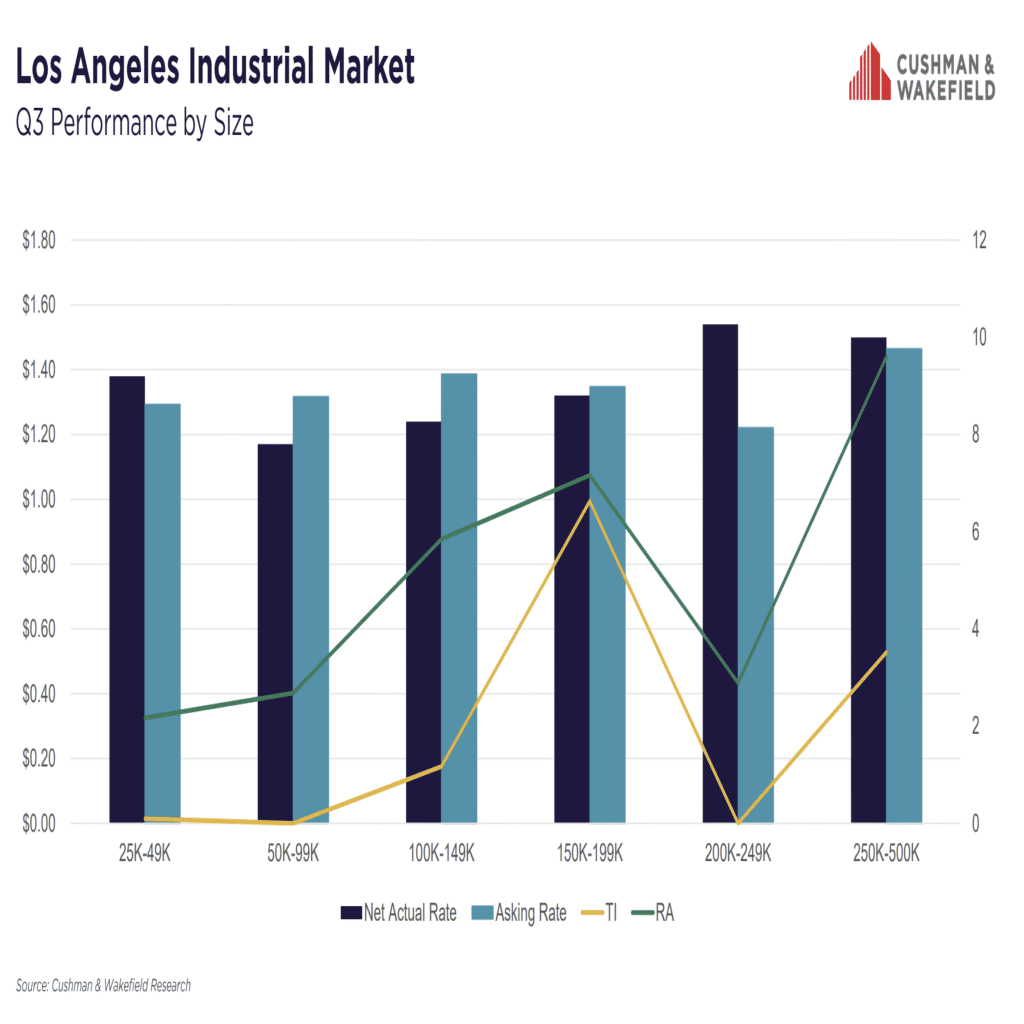

Mid-sized warehouses – those spanning roughly 25,000 to 100,000 square feet – remain highly sought after. They’re frequently utilized for quick deliveries alongside localized distribution, exhibiting remarkably low emptiness rates, generally below 4%. While bigger properties (200,000–500,000 square feet) show a bit more availability at approximately 6%, locations near highways, shipping hubs, and cities keep rental costs robust.

These days, property owners are shifting gears. Asking rates are a bit higher than what renters actually pay – with incentives like money for office updates or temporary rent cuts becoming typical. For the first time in ages, tenants have some leverage.

Los Angeles continues to be a prime place for investments. Property deals there yield returns of 4.75% to 5.25%, some of the lowest rates nationwide, indicating continued investor confidence. Other cities typically offer around 6%.

Cushman & Wakefield’s dealmakers had a remarkable 2024. Spearheaded by John Minervini, Robin Dodson, Erik Larson, Chris Tolles, alongside Paul Sims, the Transaction Management Portfolio Group finalized 182 deals – totaling $638 million, a rise of 8% over last year – covering upwards of six million square feet. Clients feature giants such as Red Bull, Amazon, Boeing, yet also Pharmavite.

Folks keep saying good things. The person at Red Bull who handles buildings described our effort as smart alongside smooth; meanwhile, someone high up at WorldPac noted we made tricky property dealings understandable – even neat.

By 2025, LA’s warehouses seem to have found their footing; things feel more balanced between what’s available and what people need, so backers are thinking ahead. Though the rush has calmed, industry still powers the city.